south dakota property taxes by county

Print Summary View Print Detail View. In South Dakota the county treasurer is responsible for issuing motor vehicle titles licenses registrations and recording liens on about one million vehicles a year.

If you experience any difficulties that affects your ability to access information on Minnehaha Countys website please send a detailed message to the Webmaster.

. Learn more about South Dakota property taxes. Although the Division of Motor Vehicles is the central state office for maintaining accurate motor vehicle records it is the county treasurer who enters the vehicle. Welcome to Grant County South Dakota.

South Dakota County Commissioners. For more details about the property tax rates in any of South Carolinas counties choose the county from the interactive map or. The Director of Equalization assesses all of the property in Grant County.

In-depth content for South Dakota County Auditors on calculating growth percentage CPI Relief Programs TIF and other property tax essentials. For any other requests for accessibility or accommodations at Minnehaha County please contact Human Resources at 605-367-4337 or by Human Resources Contact Form. - or - Statement Number.

Tennessee has one of the lowest median property tax rates in the United States with only nine states collecting a lower median property tax than Tennessee. Property is defined as the house a garage and the lot upon which it sits or one acre whichever is. This program reduces property taxes on a graduated scale based on income.

- or - Parcel Number. The Sheriff provides law enforcement jail services 911 and 247 programs for the County. Tennessees median income is 52201 per year so the median yearly property tax paid by.

In-depth content for South Dakota County Auditors on calculating growth percentage CPI Relief Programs TIF and other property tax essentials. Beaufort County to a low of 29300 in Chesterfield County. 211 9th Street South Fargo ND 58103.

The median property tax in Tennessee is 93300 per year068 of a propertys assesed fair market value as property tax per year. The Coroner investigates unattended deaths. - - - Parcel Number Address Jurisdiction Active ParcelNumber Address.

All financial matters of the County and calculating property taxes.

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts

Relative Value Of 100 Map Usa Map Cost Of Living

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

Oil Boom Texas History History Petroleum Engineering

More Pictures Of The 68 Million Stone Mansion In Alpine Nj Stone Mansion Mansions Mansions Luxury

Pin By Chester Mcvay On Maps 2018 Fun Facts Map World Map

10 States With No Property Tax In 2020 Property Tax Property Investment Property

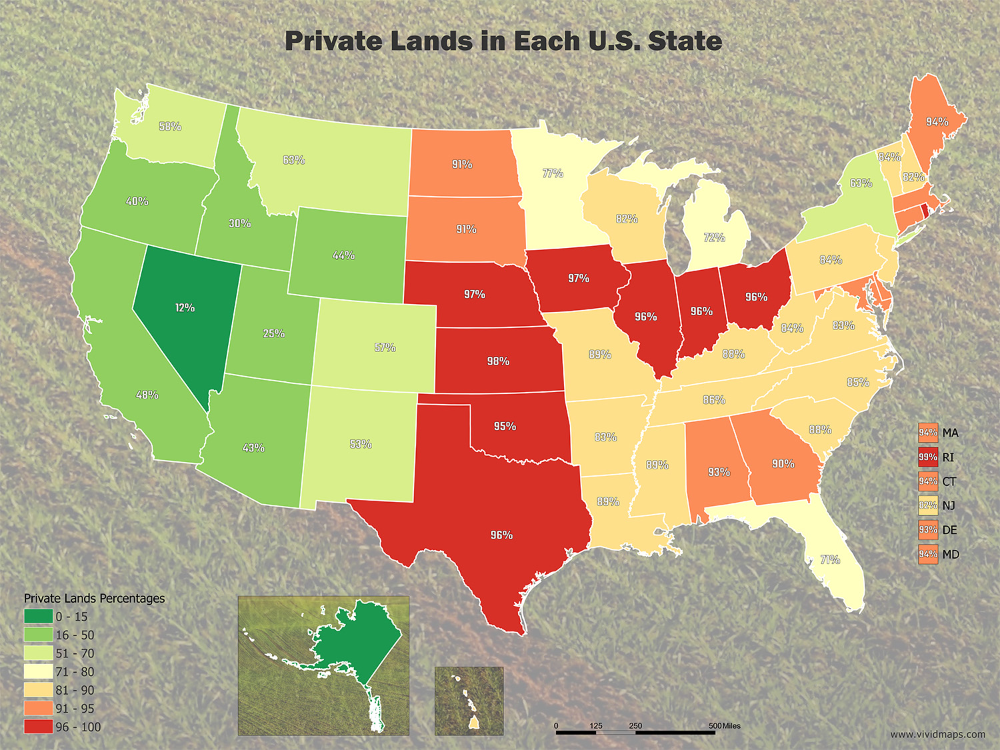

Value Of Private Land In The U S Mapped Vivid Maps Us Map Grand Canyon National Park Private

13 00 Acres Land Is For Sale In Arkansas Hot Springs Arkansas Arkansas Land Bismarck

Life Expectancy By U S State Infographic Map Facts About America Map

Mapped The Cost Of Health Insurance In Each Us State Healthinsuranceproviderscorner Travel Insurance Healthcare Costs Medical Insurance

Several Proposed Us States Throughout History Maps Interestingmaps Interesting U S States Illustrated Map Map

You Can File A Propertytaxappeal If You Think The Rate Is Too High You Will Probably Not Want To Do All The Paperwork Yourself And Property Tax Tax Graphing

Farmers Property Taxes Soar 300 400 Due To A Combination Of Low Cropprices Other Factors On Tax Calculation Farmer Property Tax Soar

Louisiana Quit Claim Deed Form Quites Louisiana Louisiana Parishes

Chart 4 Florida Local Tax Burden By County Fy 2015 Jpg Florida Local Burden Low Taxes

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States